Vehicle Sales Tax In North Dakota . unlike many other states, north dakota doesn’t have local sales tax; consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. 2% is the most car sales tax you’ll pay in north dakota. north dakota sales tax is comprised of 2 parts: When you sell your car,. What do i need to do when i sell my car in north dakota? there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired.

from www.signnow.com

When you sell your car,. unlike many other states, north dakota doesn’t have local sales tax; there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. What do i need to do when i sell my car in north dakota? 2% is the most car sales tax you’ll pay in north dakota. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. north dakota sales tax is comprised of 2 parts:

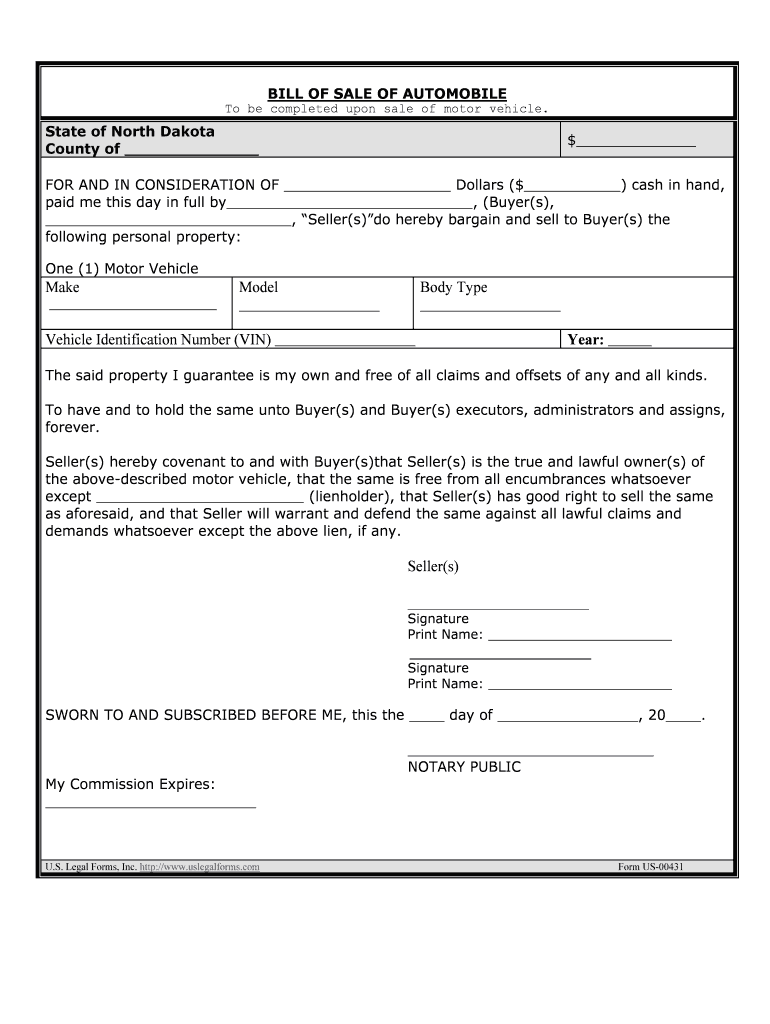

North Dakota Vehicle Bill of Sale Form Templates Fillable Fill Out and Sign Printable PDF

Vehicle Sales Tax In North Dakota What do i need to do when i sell my car in north dakota? there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. 2% is the most car sales tax you’ll pay in north dakota. What do i need to do when i sell my car in north dakota? When you sell your car,. unlike many other states, north dakota doesn’t have local sales tax; north dakota sales tax is comprised of 2 parts:

From www.pinterest.co.uk

North Dakota Vehicle Bill of Sale Form Download the free Printable Basic Bill of Sale Blank Form Vehicle Sales Tax In North Dakota 2% is the most car sales tax you’ll pay in north dakota. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. When you sell your car,. What. Vehicle Sales Tax In North Dakota.

From handypdf.com

Vehicle Bill of Sale Form North Dakota Edit, Fill, Sign Online Handypdf Vehicle Sales Tax In North Dakota there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. unlike many other states, north dakota doesn’t have local sales tax; vehicles purchases. Vehicle Sales Tax In North Dakota.

From templatesowl.com

Free North Dakota Car Bill of Sale Template Fillable Forms Vehicle Sales Tax In North Dakota consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. When you sell your car,. there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. this system will provide online motor vehicle. Vehicle Sales Tax In North Dakota.

From 1stopvat.com

North Dakota Sales Tax Sales Tax North Dakota ND Sales Tax Rate Vehicle Sales Tax In North Dakota When you sell your car,. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. 2% is the most car sales tax you’ll pay in north dakota. north dakota sales tax is comprised of 2 parts: unlike many other states, north dakota doesn’t have local sales. Vehicle Sales Tax In North Dakota.

From billofsale.net

Free North Dakota Impound Bill of Sale SFN 2902 Form PDF Word (.doc) Vehicle Sales Tax In North Dakota north dakota sales tax is comprised of 2 parts: this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. When you sell your car,. What do i need to do when i sell my car in north dakota? vehicles purchases are some of the largest sales commonly made. Vehicle Sales Tax In North Dakota.

From zamp.com

Ultimate North Dakota Sales Tax Guide Zamp Vehicle Sales Tax In North Dakota vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. When you sell your car,. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. What do i need to do when i sell my. Vehicle Sales Tax In North Dakota.

From www.cashforcars.com

How to Sign Your Car Title in North Dakota Vehicle Sales Tax In North Dakota unlike many other states, north dakota doesn’t have local sales tax; 2% is the most car sales tax you’ll pay in north dakota. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. there is hereby imposed an excise tax at the rate of five percent on the. Vehicle Sales Tax In North Dakota.

From www.salestaxhandbook.com

North Dakota Sales Tax Rates By City & County 2024 Vehicle Sales Tax In North Dakota What do i need to do when i sell my car in north dakota? vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. 2% is the. Vehicle Sales Tax In North Dakota.

From webinarcare.com

How to Get North Dakota Sales Tax Permit A Comprehensive Guide Vehicle Sales Tax In North Dakota north dakota sales tax is comprised of 2 parts: there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. 2% is. Vehicle Sales Tax In North Dakota.

From elissatyson.blogspot.com

north dakota sales tax on vehicles Elissa Tyson Vehicle Sales Tax In North Dakota unlike many other states, north dakota doesn’t have local sales tax; consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. north dakota. Vehicle Sales Tax In North Dakota.

From www.formsbank.com

Schedule S1A North Dakota Sales And Use Tax Return printable pdf download Vehicle Sales Tax In North Dakota When you sell your car,. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. unlike many other states, north dakota doesn’t have local sales tax; north dakota sales tax is comprised of 2 parts: 2% is the most car sales tax you’ll pay in north. Vehicle Sales Tax In North Dakota.

From exotpwkbz.blob.core.windows.net

Lowest Car Sales Tax In Us at Caroline Doe blog Vehicle Sales Tax In North Dakota consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. north dakota sales tax is comprised of 2 parts: When you sell your car,. What do i need to do when i sell my car in north dakota? this system will provide online motor vehicle fee. Vehicle Sales Tax In North Dakota.

From blog.accountingprose.com

North 2023 Dakota Sales Tax Guide Vehicle Sales Tax In North Dakota north dakota sales tax is comprised of 2 parts: 2% is the most car sales tax you’ll pay in north dakota. unlike many other states, north dakota doesn’t have local sales tax; vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. there is. Vehicle Sales Tax In North Dakota.

From stepbystepbusiness.com

North Dakota Sales Tax Calculator Vehicle Sales Tax In North Dakota 2% is the most car sales tax you’ll pay in north dakota. consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. . Vehicle Sales Tax In North Dakota.

From legaltemplates.net

Free North Dakota Motor Vehicle Bill of Sale Form Vehicle Sales Tax In North Dakota this system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax. 2% is the most car sales tax you’ll pay in north dakota. vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. When you sell your car,.. Vehicle Sales Tax In North Dakota.

From www.numeralhq.com

North Dakota Sales Tax Guide 2024 Compliance, Rates, and Regulations for Businesses Vehicle Sales Tax In North Dakota 2% is the most car sales tax you’ll pay in north dakota. north dakota sales tax is comprised of 2 parts: vehicles purchases are some of the largest sales commonly made in north dakota, which means that they can lead to a hefty. unlike many other states, north dakota doesn’t have local sales tax; When you sell. Vehicle Sales Tax In North Dakota.

From bestlettertemplate.com

North Dakota Bill of Sale for DMV, Car, Boat PDF & Word Vehicle Sales Tax In North Dakota north dakota sales tax is comprised of 2 parts: What do i need to do when i sell my car in north dakota? consider how an 8% sales tax on a $15,000 car can unexpectedly increase your total cost by $1,200, excluding additional fees. 2% is the most car sales tax you’ll pay in north dakota. this. Vehicle Sales Tax In North Dakota.

From www.formsbank.com

Fillable Form St Sales, Use, And Gross Receipts Tax North Dakota Tax Commissioner printable Vehicle Sales Tax In North Dakota unlike many other states, north dakota doesn’t have local sales tax; When you sell your car,. there is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired. north dakota sales tax is comprised of 2 parts: What do i need to do when i. Vehicle Sales Tax In North Dakota.